maricopa county irs tax liens

Ad See Anyones Public Records All States. The initial step is for the IRS or local tax agency to decide that a person truly owes back.

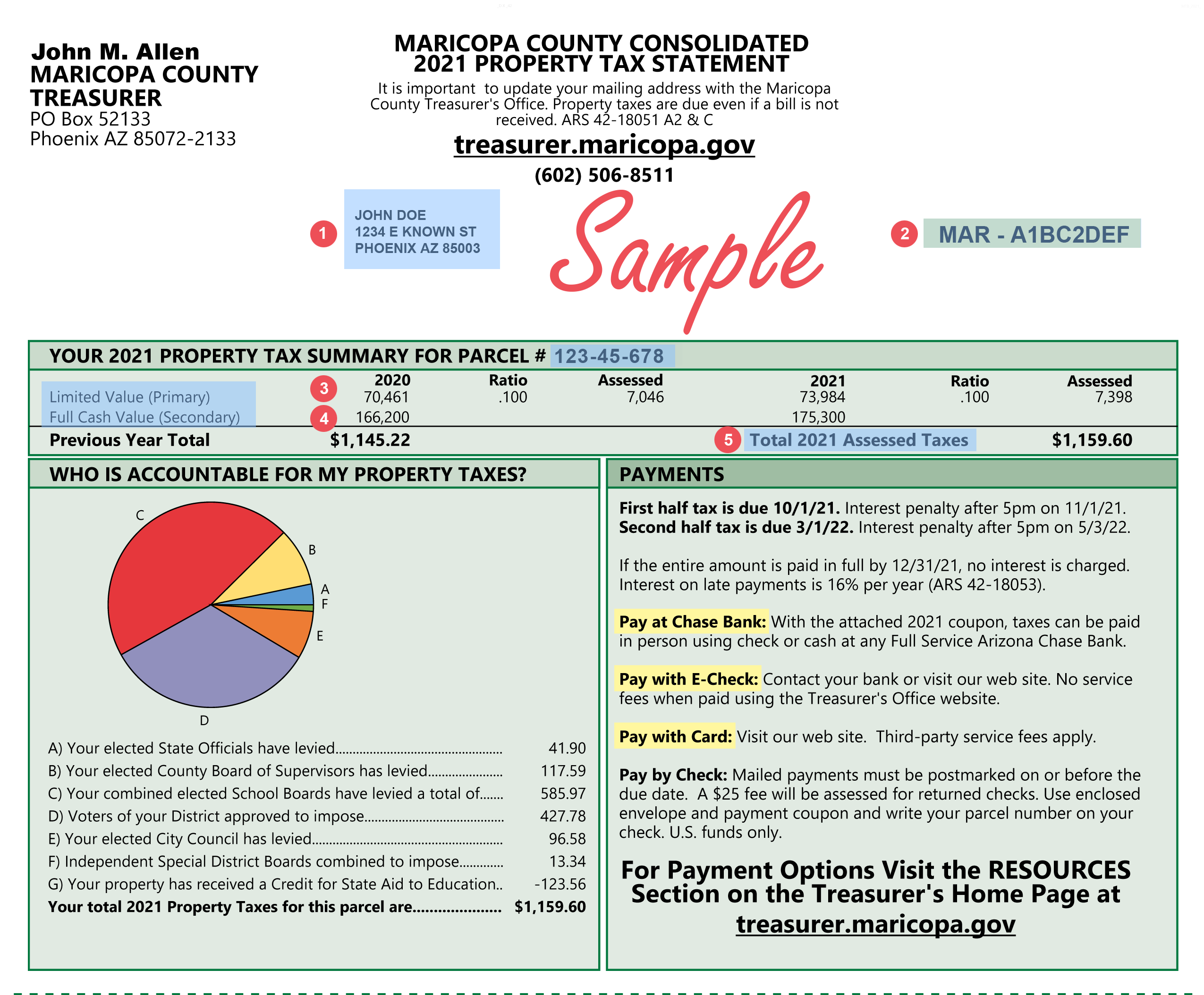

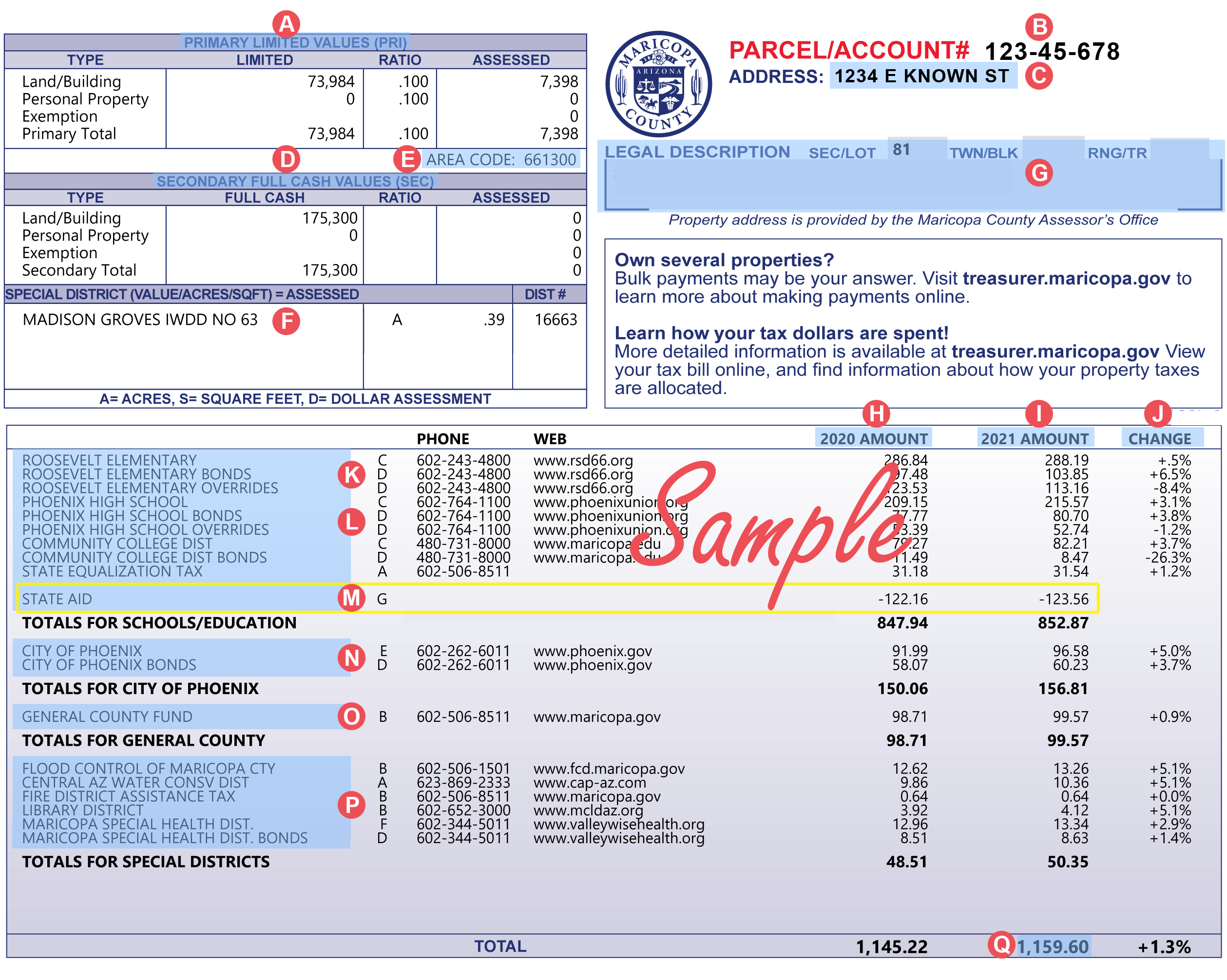

Maricopa County Treasurer S Office John M Allen Treasurer

Search Any Address 2.

. Check your Arizona tax liens. In fact IRS liens priority is based on the order recorded. The prior calendar year fees paid toward these earnings will appear after you successfully log-in to Tax Lien Web.

Ad Search Information On Liens Possible Owners Location Estimated Value Comps More. The Maricopa County Treasurers Office does not guarantee the positional accuracy of the Assessors parcel boundaries displayed on the map. Directing the Maricopa County Arizona Treasurer to execute and deliver to the purchaser of the Maricopa County Arizona tax lien certificate in whose favor the judgment is entered including.

Type Any Name Search Now. The process of imposing a tax lien on property in Maricopa County Arizona is typically fairly simple. Enter Name Search Risk Free.

In fact the rate of return on property tax liens investments in. The Arizona Tax Department was established in September 1988 and has jurisdiction over disputes anywhere in the state that involves the imposition assessment or collection of a tax. Upon receipt of a cashiers check or certified funds the Department of Revenue will immediately provide a Notice of Intent to Release State Tax.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties. Maricopa County AZ currently has 18139 tax liens available as of August 29. Tax liens offer many opportunities for you to earn above average returns on your investment dollars.

Ad Find Anyones Taxes Liens. The interest rate paid to the county on delinquent taxes is 16. When a lien is auctioned it is possible for the bidder to.

There are 3 IRS Offices in Maricopa County Arizona serving a population of 4155501 people in an area of 9198 square miles. View Anyones Arrests Addresses Phone Numbers Aliases Hidden Records More. Payment in full with Cash or Certified Funds.

All groups and messages. See Available Property Records Liens Owner Info More. The Segment 1 video for the federal tax lien discharge and subordination process introduces the.

Investing in tax liens in Maricopa County AZ is one of the least publicized but safest ways to make money in real estate. Just remember each state has its own bidding process. Applying to the IRS for a Lien Discharge or Subordination.

Consult with your accountant or tax preparer if you have any questions. There is 1 IRS Office per.

Response To Petition For Legal Separation With Children Drlsc31f Pdf Fpdf Docx

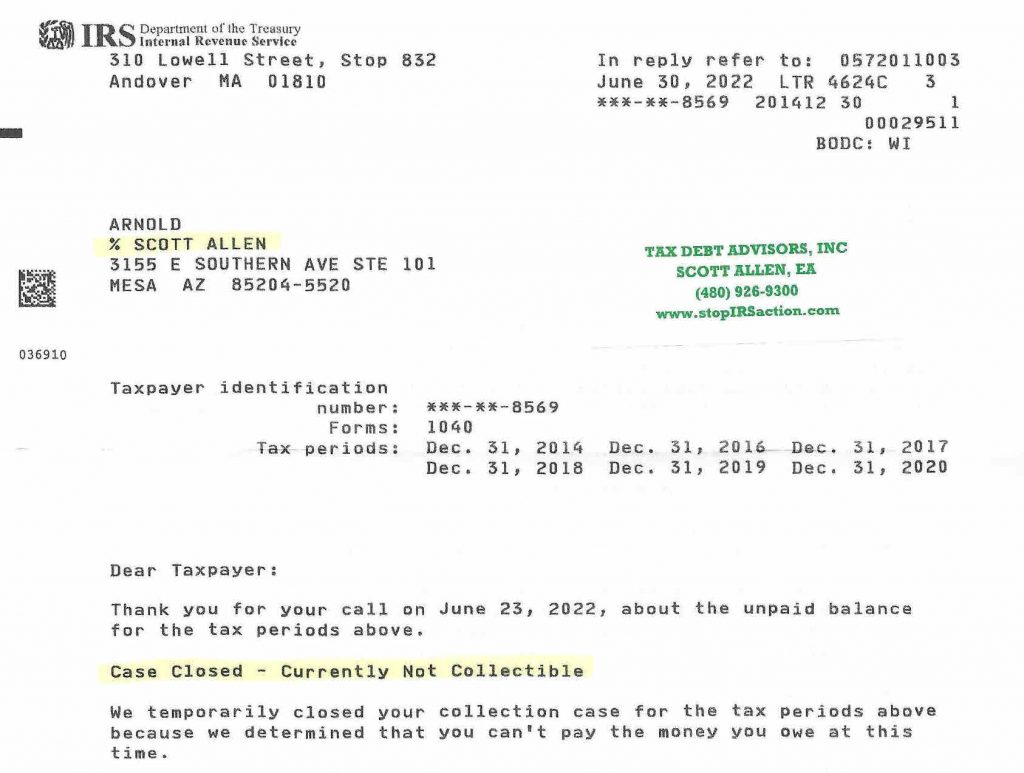

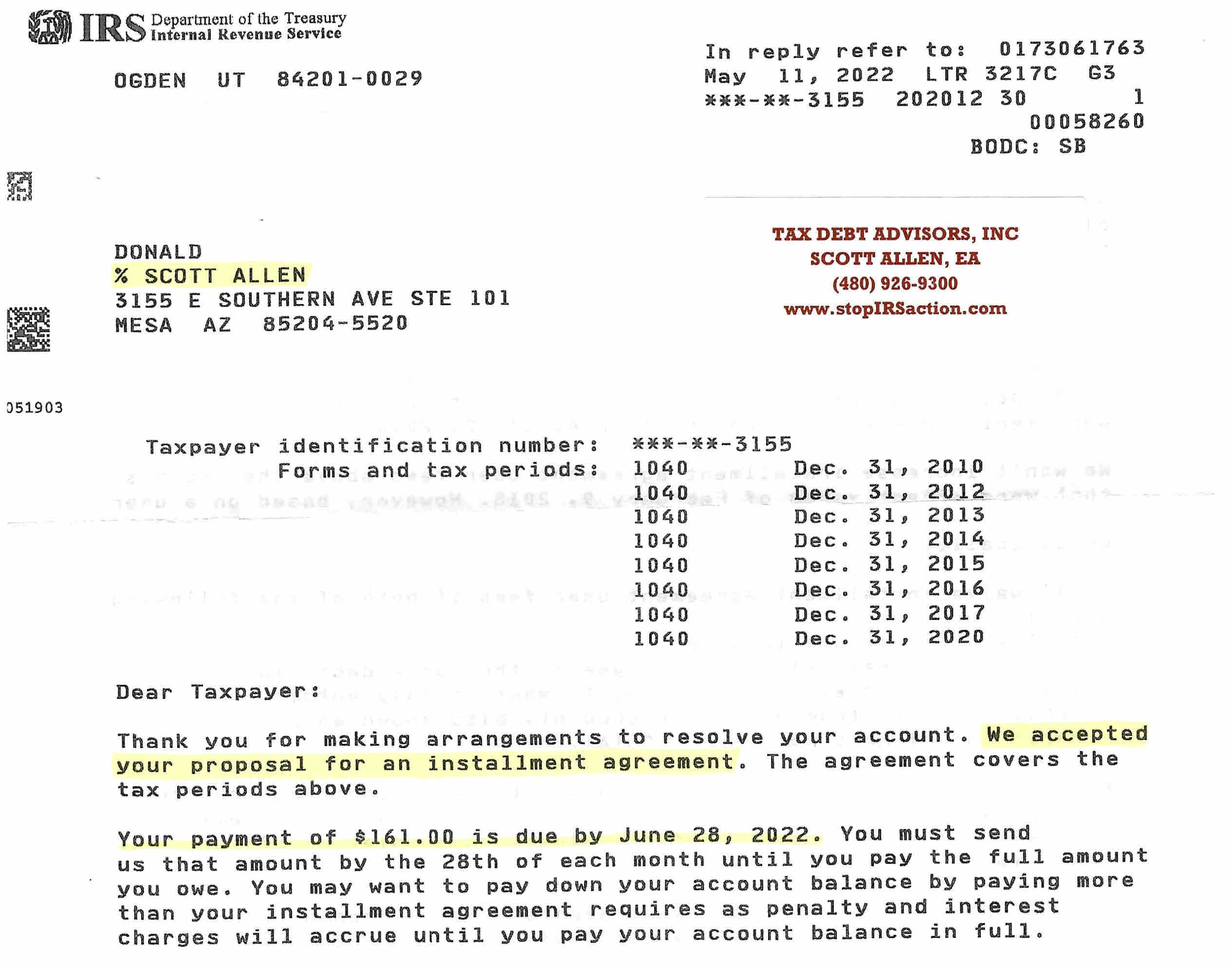

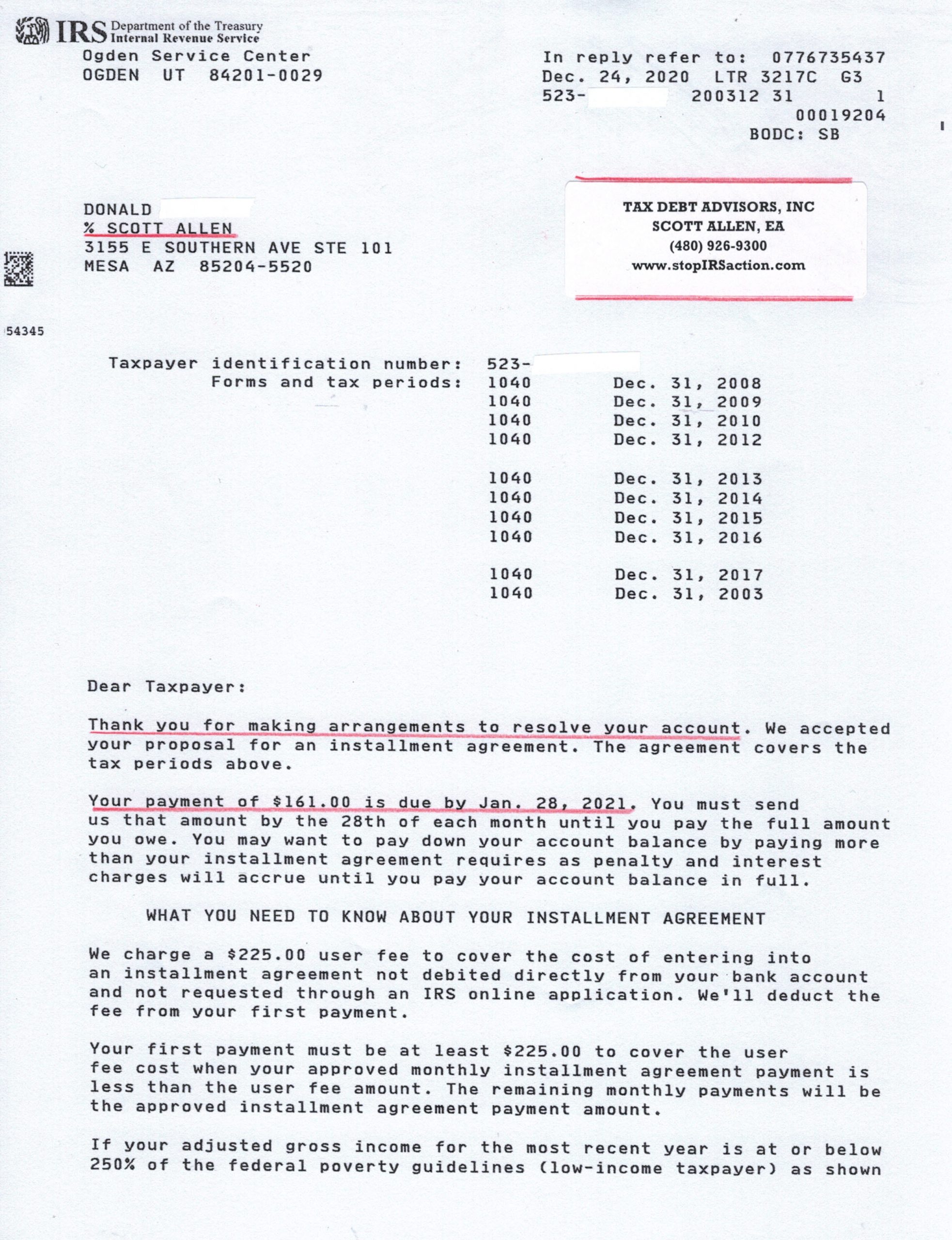

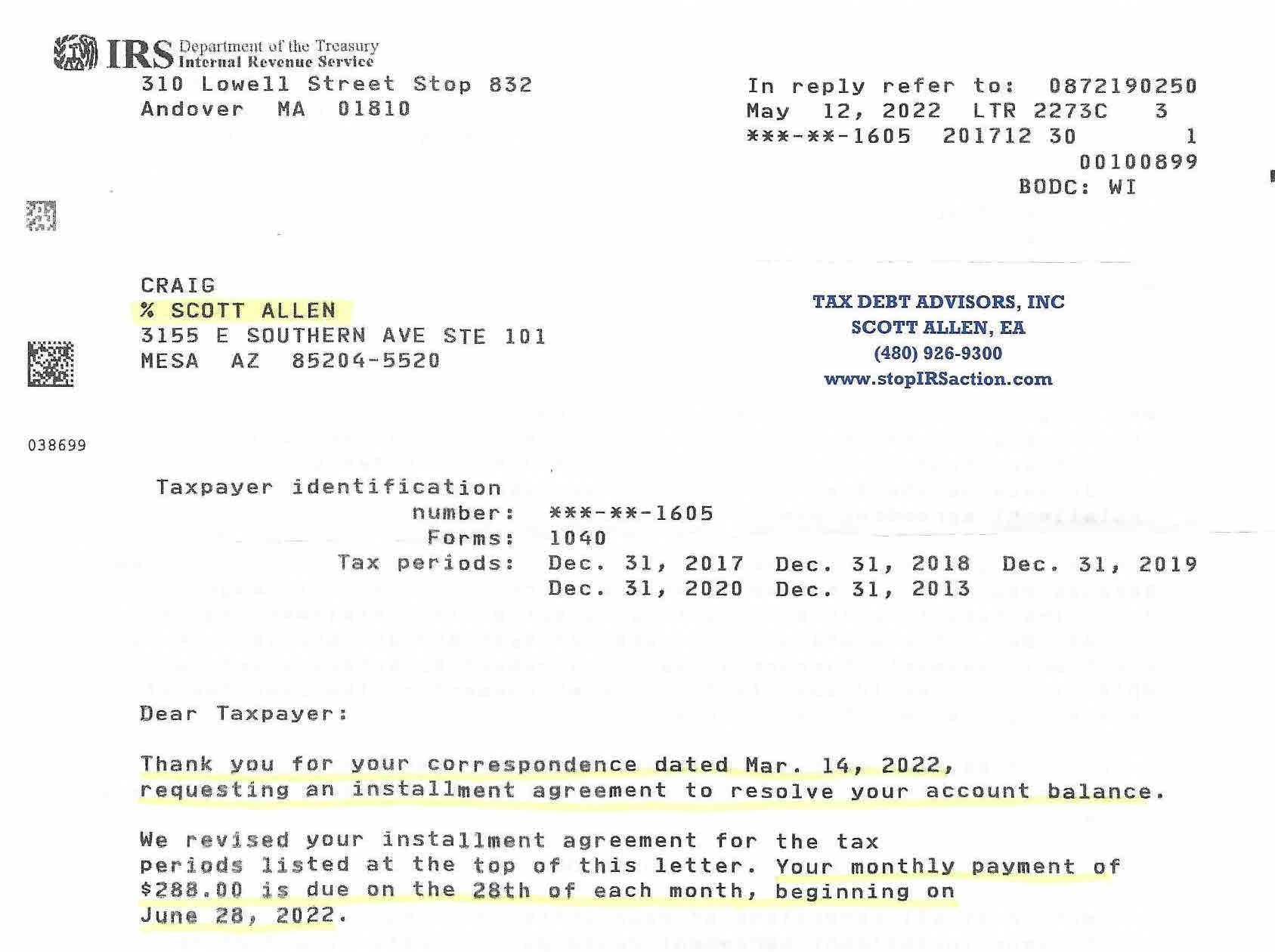

Irs Tax Lien Problems Tax Debt Advisors

An Interview With The Maricopa County Treasurer Asreb

Foreclosure Of Association S Assessment Lien And Tax Liens Hoa Lawyer

Irs Tax Lien Problems Tax Debt Advisors

Irs Tax Lien Problems Tax Debt Advisors

Irs Tax Lien Problems Tax Debt Advisors

An Interview With The Maricopa County Treasurer Asreb

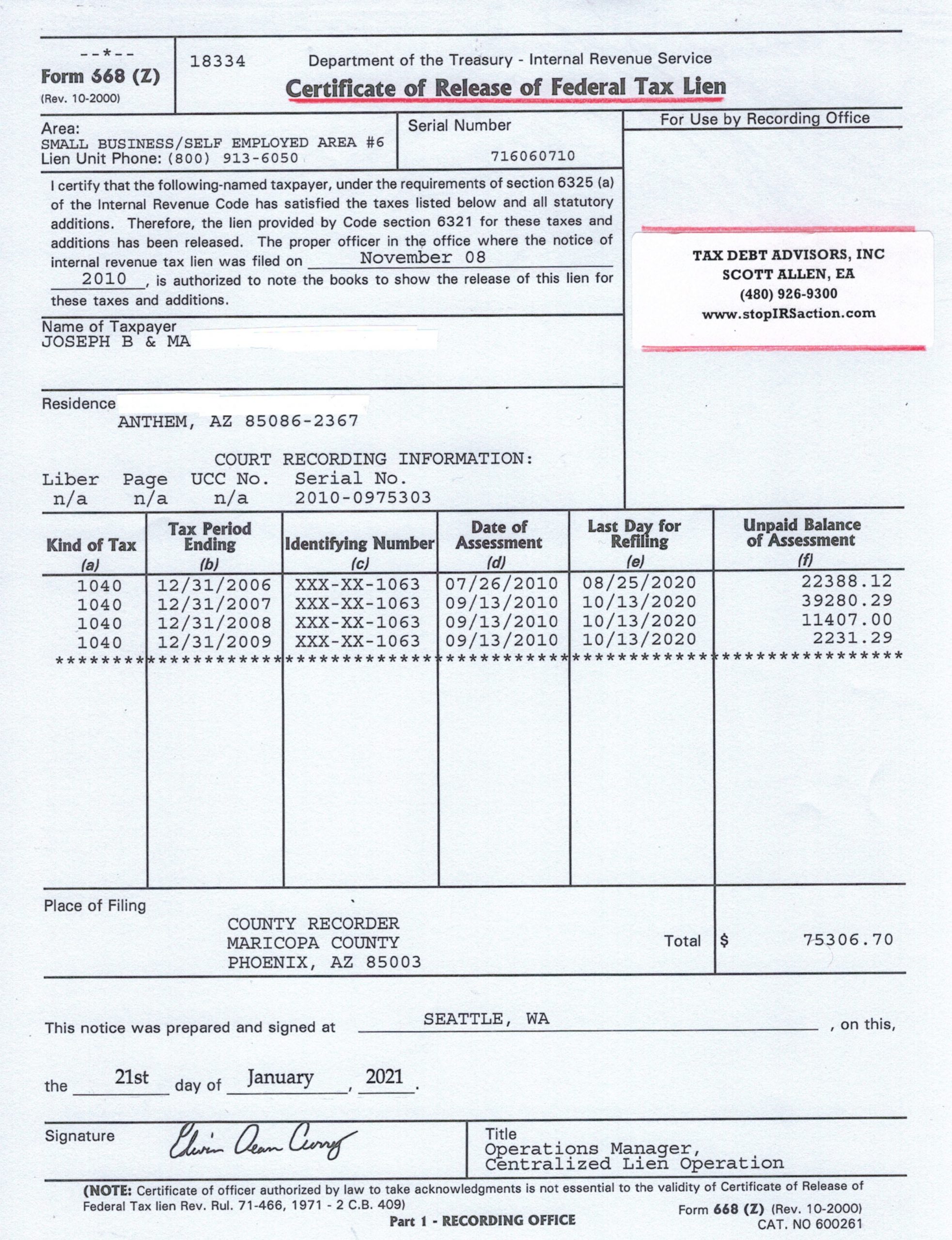

Irs Tax Lien In Arizona Irs Help From Tax Debt Advisors Inc Tax Debt Advisors

Pin By Sun City Home Owners Associati On Schoa Sun City Arizona House Styles Mansions

The Basics Of Tax Liens Arizona School Of Real Estate And Business

Fillable Online Clerkofcourt Maricopa Maricopa County Summons Form Fax Email Print Pdffiller